WORKING WITH DG ECHO AS AN NGO PARTNER | 2021 - 2027

RISK ASSESSMENT OF THE FINANCIAL MANAGEMENT CAPACITY OF THE PARTNER

The Financial Regulation lays particular emphasis on the importance for the Commission to ensure that organisations receiving EU funding have the required financial capacity enabling it to complete the EU funded actions concerned.

DG ECHO has therefore put in place risk mitigation measures to protect the financial interest of the EU where the financial situation of the partner does not provide full assurance in this respect.

These measures may vary depending on the specificity of the partnership and the nature of the actions funded.

The actions funded by DG ECHO may therefore be subject to appropriate controls, at the grant award and final payment stages, based on the risk assessment of the partner’s financial capacity.

As a rule the risks are assessed yearly (this frequency can be adjusted depending on the risk profile of the partner), during the partner's periodic assessment, based on the financial statements provided by partners.

The partner has access through APPEL (logbook) to the result of this risks assessment.

A) RISKS AT CONTRACTING STAGE

At contracting stage, DG ECHO will evaluate the risks it takes in pre-financing an action, by assessing the capacity of the partner to fund its activities in the short and medium term; the risk is that a partner does not implement the action and the pre-financing cannot be recovered.

The financial solidity of the partner will be assessed, during the partner's periodic assessment, using standard financial indicators, such as net equity, net result and liquidity ratio. The benchmarks to assess the level of risk assumed by DG ECHO when pre-financing an action will be fixed on the basis of two indicators:

- Liquidity ratio (i.e. current assets / short-term liabilities): the NGO should be capable of covering its short term commitments, i.e. paying its charges when they are due.

According to Commission standards, the ratio should be generally higher than 1 (this means that current assets should be higher than short term liabilities).

In order to take into consideration the particularities of humanitarian action, the benchmark has been fixed by DG ECHO at 0,85.

- Financial independence [i.e. equity (non-restricted funds) / total liabilities]: this ratio gives an idea of the NGO's solvency, i.e. the capacity of the NGO to operate in the future, being capable of covering its medium and long term commitments.

According to Commission standards, the ratio should be above 20%. The partners whose indicators are above both thresholds may sign Grant Agreements with DG ECHO without any particular limitation.

Partners which have a liquidity ratio below 0.85 are considered as not meeting the criteria to remain a partner. In such case, DG ECHO will withdraw their Certificate unless remedial measures are taken providing sufficient guarantees to DG ECHO that the financial interests of the EU are adequately protected (e.g. one or several other NGOs guarantee to cover possible financial default by the partner concerned).

For partners whose financial independence is below 20%, DG ECHO's financial exposure should be limited to a given amount.

The exposure of DG ECHO is the total amount of pre-financings paid to the organisation and not yet claimed as consumed by a declaration of expenditure or an intermediate or final report.

This exposure is referred to as ‘open amount’. This risk exposure, referred to as the ‘threshold’, should not exceed 20% of the organisation's operating income.

The operating income will be extracted from the latest certified audited accounts.

Before signing a Grant Agreement with a partner in this situation, DG ECHO will look at the partner's threshold and open amount.

In case of a multi-partner grant agreement, where some of the co-partners have a threshold, this will have to be taken into account for the sharing of the open amount among them.

In most cases, the threshold will have no influence as it will be higher than the open amount.

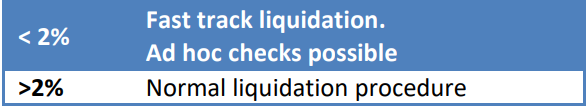

In those cases where the open amount is higher than the threshold and that DG ECHO wants to sign a new agreement, DG ECHO might decide to impose mitigating measures (see table above).

B) RISK ASSESSMENT AT LIQUIDATION STAGE

The risk assessment at liquidation stage consists of analysing the capacity of the partner to manage the financial and procedural aspects of an action, and more precisely the level of assurance to claim eligible expenditures.

Based on this assessment, DG ECHO will adapt its financial controls at liquidation stage, i.e. when analysing the final financial report.

C) HOW CAN A PARTNER REQUEST A REVISION OF ITS RISKS ASSESSMENT?

The risk assessment will be performed once per year on the basis of the information provided by the partner and the results of the controls performed by the different European bodies involved in checking the eligibility of expenditures. The assessment will be done at the time of the periodic assessment mentioned above.

Together with the conclusions of the periodic assessment, the partner will receive the revised risks assessment.

The partner has at any time the possibility to contact DG ECHO when it is in possession of new elements which might have an impact on DG ECHO assessment.