WORKING WITH DG ECHO AS AN NGO PARTNER | 2021 - 2027

ELIGIBILITY OF COSTS

As stated in the Article 6.1 (a) (ii) of the MGA, costs related to the preparation of the final report shall be deemed eligible even if incurred after the eligibility period of the Action.

Therefore, if linked to the preparation of the final report (max. 3 months), office running costs may be eligible, provided that they are reasonable, justified and compliant with the principle of sound financial management, in particular regarding economy and efficiency. In order to avoid costs to be charged twice, in case of follow-up action, these costs are no more eligible.

It's possible to charge a depreciation rate related to the local office building. This is different from a mortgage loan, which is not eligible under the MGA.

The reference is Article. 6.2 C.2 Equipment of the MGA according to which: [...] If such equipment, infrastructure or other assets are rented or leased, full costs for renting or leasing are eligible, if they do not exceed the depreciation costs of similar equipment, infrastructure or assets and do not include any financing fees.

There is no fixed threshold applicable to personnel costs, but they must respect the eligibility conditions listed in Article 6.2 (A) of the MGA (e.g. being directly linked and necessary for the Action). If the costs devoted to human resources are very high (for example, in the case of protection activities), it may be advisable to explain the reason in the Single Form.

IMPLEMENTING PARTNERS | DEPRECIATION

Depreciation or rental costs for the use of durable equipment may be charged to the DG ECHO funded Action in proportion to its actual use as long as the rules on eligibility in Article 6.2 (C.2) are observed. This option is foreseen for both, the Partner and Implementing Partner as far as the depreciated equipment was necessary for the implementation of the action.

The depreciation/rental costs must be reflected in the accounting system in a consistent and verifiable way. An important exception to this is if the durable equipment was bought using DG ECHO funding. In cases where DG ECHO has already covered or contributed to the purchase cost of a part of durable equipment the related depreciation or rental costs can never be charged to a future DG ECHO funded Action. This practice is contrary to normal financial safeguards and would constitute double funding. In cases where it is not possible to charge rent/depreciation to a DG ECHO funded Action it may still be possible to charge the maintenance and running costs of that durable equipment to the Action's budget.

Under the general applicable rules on cost eligibility, the Commission can only pay for a cost when it has, amongst other criteria, been correctly "incurred".

In humanitarian aid actions, provisions exist to determine the moment that a cost has been incurred with regard to goods, equipment, services or works used in connection with the Action. No guidance or interpretation, however, exists as yet to determine when, in the context of Actions involving cash distribution to final beneficiaries, the cash transfer or financial transaction is considered complete and the cost is therefore deemed 'incurred'.

It is widely established that the fact that a legal commitment has been made (e.g. signature of a legally binding agreement or issuing a purchase order) is not sufficient for the costs to be deemed 'incurred'. Likewise the fact that an accounting provision has been made (e.g. money has been placed in an account with a view to being distributed) cannot be sufficient to deem those costs as 'incurred'.

In the case of humanitarian supplies ECHO's provisions require that the costs should relate to supplies distributed/made available to the beneficiaries during the eligibility period of the Action. It would seem appropriate to extend this approach also to cash-based distributions with the following context-specific qualification:

a) where the money to be distributed to the final beneficiaries is held in a bank or other equivalent holding mechanism used by mobile phone operators, hawala agents, etc in the name of one or more humanitarian organisations - the cost shall be deemed incurred when the money has been distributed to the final beneficiary or his/her representative. Money is considered 'distributed' the moment that the beneficiary has access to it. For example, money does not actually need to be withdrawn for costs to be considered as incurred.

It is however good practice to provide a specific timeframe to beneficiaries during which the money may be accessed;

b) where the money to be distributed to the final beneficiaries is deposited directly into a bank or equivalent account in the name of the final beneficiaries, or is handed over directly to the beneficiary - the cost shall be deemed incurred at that point.

Partner should be prepared to demonstrate that a cost has been actually incurred, for instance, during ECHO audits or verifications. Auditors or Verifiers may ask to visit specific Action locations (distribution points etc.) to verify that the money has been deposited during the eligibility period. During an HQ audit/verification, Commission representatives may check all the supporting documents related to the Action and the relevant dates (including bank accounts and statements).

No. Field office costs have to be declared as unit costs in accordance with the Partners' usual accounting practices. It is enough if the Partner fills-in column D2 in Annex 2 - Budget. No additional details need to be provided in the e-SF. The methodology and application of the usual accounting practices will be verified at audit stage.

If for the purpose of the grant Partner’s staff have to travel to other locations, then the travel costs and per diem are justified under the condition that they are not getting paid twice (once by their employer and another time by the beneficiary ). Some supporting documents/declarations can be requested at final report stage or audit.

It is up to the beneficiary to check the status of the personnel involved in the action. If they are performing some extra tasks or extra hours or are detached from their health centre and sent to some other locations then the extra remuneration can be justified.

Low value equipment (equipment with a value below EUR 1000 under the MGA, instead of previous EUR 750 per item under the FPA2014) is exempted from the obligation to transfer.

If the cost of the item is between EUR 1001 and EUR 2500 per item, the exception applies if the total costs of the items does not exceed EUR 15 000.

Remaining goods at the end of the Action should, ideally, be distributed by requesting a no-cost-extension of the Action. If this is not possible and the results of the Action have been achieved, remaining goods not exceeding 20% of goods per type of goods (e.g drugs, food, NFI kits.) purchased during the Action, the Partner does not have to report to DG ECHO on the final use, but the foods have to be used for the benefit of humanitarian aid actions. The final use of these goods will be verified at audit stage.

The contractual provision on this point can be found in Annex 5 of the MGA (‘Transfer of assets at the end of the Action’) while detailed guidance is available in the AGA – Annex 5.

In principle in the MGA, reimbursement of full price of equipment and goods is the rule, with the obligation to transfer or donate them after the end of the action, unless exempted by DG ECHO. If transfer to another ongoing action is not possible and if agreed by DG ECHO, the Partner can transfer or donate the equipment or goods to the final recipients, local non-profit organisations, international non-profit organisations, international organisations, or local authorities. If not, only the depreciation costs are eligible (regardless of the fact the Commission is the single largest donor of the action).

Yes. Preparation of final report, post-distribution monitoring, final evaluation and exceptional audit costs are eligible.

Those costs are eligible maximum 3 months after the end of the action (deadline for submission of the final report). In principle, costs related to the final report are eligible only after the end of the Action (or at the earliest one month before the end of the Action).

Co-beneficiaries decide on the allocation of the budget of the action among themselves.

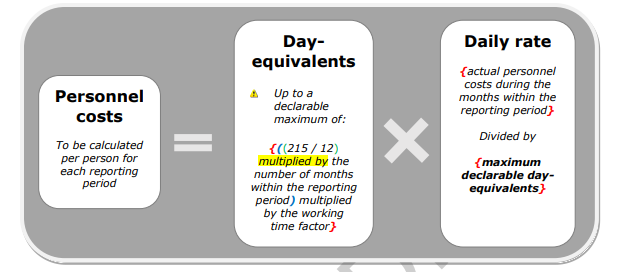

Yes. The costs of staff on leave are to be added to the actual personnel costs incurred within the reporting period. Those costs should then be divided into the maximum declarable day-equivalents for the purpose of calculation of the daily rate.

No. Cost will be eligible only when incurred after the project starting date. Implementation period and eligibility period coincide.

Reference documents on staff and field office costs are published on DG ECHO Partners’ website, namely: DG ECHO Decision on the use of unit costs for staff and field office costs and Staff Costs calculation guidance. Hereunder are briefly described the two alternative methods for the personnel costs’ calculation:

Staff costs (HQ and field) can be declared on the basis of actual costs and calculated in accordance with the following formula, provided for in the Model Grant Agreement:

The number of day-equivalents declared for a person must be identifiable and verifiable (for instance through time sheets). Further explanation is provided in the AGA (Article 6.2.A.1 Employees).

Alternatively, staff costs can be declared as unit costs calculated in accordance with the Partner’s usual costs accounting practices. The different options can be selected by filling in the correct column in the budget (Annex 2) and/or at final report stage (Annex 4). There is no need for any derogation or ex-ante approval. The unit costs methodology as well as the number of the unit declared supported by timesheets or equivalent will be checked at the audit stage.

Examples can be found in theAnnotated Grant Agreement – article 6.2.A.1

At the final report and/or audit stage

Yes, for all persons working on the action—whether full-time or part-time, and regardless of whether they work exclusively for the action or not—the partner must calculate the daily rate using one of the following methods:

- Standard method: The 215-day method as outlined in the AGA.

- Unit cost method: The so-called ‘average personnel costs,’ calculated in accordance with the partner’s usual cost accounting practices (if applicable).

Both methods require the calculation of a unit cost, which can be either an hourly or daily rate. Additionally, in both cases, timesheets must be provided to justify the number of units worked on the project.

Reliable time records must be kept, dated, and signed at least monthly by the person working on the action and their supervisor. These records can be either paper- or computer-based. If no system is available, a monthly declaration of day-equivalents worked for the action can be used.

A template for this can be found in the AGA, ARTICLE 20 — RECORD-KEEPING, on page 197.

No, a pro rata approach will not be possible.

Partner cannot charge to ECHO a percentage of incurred eligible staff cost based on time worked on the action. The time worked on the project must be converted into units (hours or days) and supported by timesheets or a monthly declaration (see Question 139). Personnel costs to be declared as direct eligible costs in ECHO grants must be calculated as follows: number of day-equivalents worked × unit cost.

Implementing Partners are always under the responsibility of the DG ECHO Partners who engage them. Therefore, the first evaluation to be conducted should consider the type of Implementing Partner involved. For example, international NGOs that are part of a family network are naturally different from local grassroots CSOs.

Implementing Partners should calculate their staff costs using the 215-day methodology (as the safest option), or alternatively using their usual accounting practices (if already in place), or the accounting practices of the ECHO Partner. The latter options can only be applied if the existing accounting practices are fully compliant with the decision on staff costs adopted by DG ECHO in 2021. It is important to emphasize that the pro-rata approach is never allowed.

Yes, low value equipment (equipment with a value below EUR 1000 under the MGA, instead of previous EUR 750 per item under the FPA2014) is exempted from the obligation to transfer. If the cost of the item is between EUR 1001 and EUR 2500 per item, the exception applies if the total costs of the items does not exceed EUR 15 000 (See FAQ 100).

Explanation provided in the Annotated Grant Agreement (art. 6.2.C.2).

Yes, if transfer is not possible.

Yes, the list of eligible costs that can be included in the category “Field office costs” is provided in the “Decision authorising the use of unit costs for staff and field office costs using usual cost accounting practices under the Humanitarian Aid Programme”.

Article 6.2 D.1 repeats the conditions set up in the 2018 Financial Regulation (Art. 204) on which basis the EU funds the actions. In Chapter 10.6 e-SF the partner provides the required information about financial support to third parties. The amount of support provided to implementing partners must be listed in the budget template (Annex 2) and financial statement (Annex 4) under category D.1.

Those are the supplementary payments for personnel assigned to the action and can be included in the calculation of the daily rate if they are part of the beneficiary’s usual remuneration practices and are paid in a consistent manner whenever the same kind of work or expertise is required, the criteria used to calculate the supplementary payments have to be objective and generally applied by the beneficiary, regardless of the source of funding used.

Yes, if duly justified and documented. Please see FAQ [216] on VAT eligibility conditions.

The definition is provided in the provisional Annotated Grant Agreement (art. 6.3 Ineligible costs and contributions) and reads as follows: ‘Excessive’ means paying significantly more for products, services or personnel than the prevailing market rates or the usual practices of the beneficiary (and thus resulting in an avoidable financial loss to the action). ‘Reckless’ means failing to exercise care in the selection of products, services or personnel (and thus resulting in an avoidable financial loss to the action).

Yes, it is, the “prove the eligibility of the costs or contributions to what the flat-rate is applied” refers in this context to the direct costs.

Yes, DG ECHO’s decision on staff costs is retroactive to 1st of January 2021. In order to reflect this in the ongoing actions, no modification request is needed. The information on staff costs can be provided at final report stage by filling in the correct column of Annex 4 to the MGA.

Costs of capacity building of partner’s staff or IPs’ staff can be accepted to the extent that they concern training which is necessary for the purposes of implementing the Action. There should be an explicit result/activity in the e-SF (Annex 1 to the MGA).

Moreover, any training related to general background skills of the partner or its IPs and their staff, and in particular any training concerning non-directly operational skills (such as HR management, IT, accountancy, language courses, first aid, etc.) are generally to be covered by the indirect cost allocation, except when these costs are described in the action proposal and are necessary to achieve a specific result of the Action. The costs of safety and security or logistic training related to the country-specific situations and the implementation of the Action, may be considered eligible.

Yes, please refer to the AGA Article 6.2.A.1 Employees. In principle, according to the new text, days of parental leave during the calendar year may be deducted from the 215 days to calculate the daily rates. The same applies to Partners who use their usual cost accounting practices to calculate personnel costs. However, the Partner may not deduct any other leaves or absences, including long-term sick leave, breastfeeding leave, leave to take care of a sick child and in case of kidnapping and persons in jail. Such clarification is considered to be retroactive to 1st of January 2021.

Headquarter or Regional Office staff costs are not eligible unless the costs relate to the monitoring of the action in the field, the preparation of the Final Report (max. 3 months) or to a specific task necessary for the achievement of the operational results and have accordingly been identified as an operational activity in Annex 1 (only costs of “technical staff” can be eligible, all administrative profiles (financial, HR, desk officer, fund raising officer), are not eligible unless no similar profile is present in the field).

In addition to pre-constituted stocks, costs of stocks pre-positioned (or stockpiling) in advance of possible disasters are eligible. Pre-positioning/Stockpiling is the constitution of emergency supplies not intended for immediate use, with the objective of reinforcing the emergency/disaster preparedness in third countries. These stocks managed by a partner should be made available to all DG ECHO Certified Partners in case of emergencies. The costs of the supplies will be considered as incurred when the supplies are delivered to the warehouse of the beneficiary.

The pre-positioning should appear in one of the results of the action under which the stocks are purchased. The beneficiary will explain why the stocks should be constituted, the nature of the supplies and how they will be handled (for instance, in case the disaster or emergency, in case limited period of usability).

At report stage, if the stocks were used during the action, the beneficiary shall explain the use that was made of the stocks. If the stocks were not used, they will update the information provided at proposal stage on the handling of the stock.

After the action, in order to avoid risks of double funding, the beneficiary should clearly label the stocks. The partner should also, at any time, be able to trace the stocks and explain its use. (For instance in case of an audit).

Exception: In certain countries, in view of possible follow-up action, beneficiaries may be authorised to pre-position stocks to avoid rupture in the procurement pipeline, subject to the following conditions:

- the delay in procuring or delivering of supplies should be due to objective logistical reasons and should not be due to problems in the procurement process of the partner that may be avoidable or manageable.

- The stocks should be proportionate to the identified possible gap in the procurement chain.

- The other stockpiling conditions (inclusion as a result in Annex 1, reporting obligations, stocks available to other partners if needed) remain applicable.

Value added tax which cannot be refunded in third countries may be considered eligible under certain conditions:

- the partner must be able to demonstrate that they requested the exemption from the relevant authorities (e.g. recent copy of letter sent to the tax authorities)

- the partner must be able to show the response of the tax authorities, or the applicable legislation which stipulate that VAT cannot be refunded.

In case there is no reply from the relevant authorities, a recent letter from the beneficiary requesting the VAT exemption or reference to the applicable legislation can be considered as a proof that VAT exemption was requested. When a beneficiary receives a VAT reimbursement of costs after the receipt of the final payment and when the VAT has already been reimbursed by DG ECHO, it is necessary to reimburse these amounts to DG ECHO. The beneficiary should contact DG ECHO in such cases. VAT rules are the same for Implementing Partners as for the lead applicant. The Implementing Partner has to request an exemption and should be able to prove that it had requested the exemption.

From the financial perspective, new and future grants should reflect the increased costs in the budget proposals. The available budget flexibility should be used whenever possible to reflect the necessary changes in the activities implemented. Where certain costs categories (e.g. travel costs, commodities, particular implementation methods...) are known to be significantly more expensive than other substitutes or alternative methods, DG ECHO Partners should strive to reduce these costs. However, costs mitigation measures are not possible or appropriate in all cases and never justify sourcing lower quality supplies (especially for food and medical supplies).

From the contractual perspective, whenever implementation costs are significantly high the Partner may request to reduce the duration of the Action in order to avoid stretching field office, staff and implementation costs. If key activities can be expedited, this would sill allow the Partners to achieve meaningful results, however, if despite best efforts it seems that the intended results would be negatively impacted, the Partner can always request an amendment to modify the description of the action and remove or adjusts the initially planned activities.

In limited cases, a modification of the Agreement could also entail an increase of the budget, but this is subject to the budget available and the operational priorities. In all cases, Partners should liaise with the Desk Officers in charge of the project to discuss the best approach on the basis of the needs.

In case an amendment is needed, the request should be submitted to DG ECHO in due time, 30 days before the end of the implementation of the Action and in any case before the submission of the FR (see FAQ 114). This allows DG ECHO to ensure a proper follow-up on the request without major impacts or uncertainties or unjustified delays in the Action’s implementation.

Cost of staff in charge of the post distribution monitoring and related running costs, costs relating to the final evaluation, both external and internal. Audit costs are eligible only if they relate to the Action itself and if this audit is an essential requirement under the applicable national legislation for the partner to operate in the country of the action) and costs necessary for the drafting of the final report (up to a maximum of 1 full time equivalent for maximum 3 months). Costs for the Final Report are eligible only after the end of the Action (or at the earliest one month before the end of the Action).

According to the specific case, two options are foreseen:

- If severance payments are paid as provision every month and fulfil the criteria listed in point 2.1.3 (referred to article 6.2.1 – Employees) of the AGA, these would be considered as staff costs even if the contract would end after the reporting period.

- If these were not initially considered in the calculation of the daily rate (e.g. Partner(s) could not foresee it) and hence added afterwards, these would fall under the Specific Case of end-of-contract indemnities as per described below, for which only (a pro-rata of) the indemnity within the reporting period would be paid and only if the contract ends within the reporting period.

Please refer to the AGA Article 6.1.A.2 Employees – End of contract indemnities during the Action.

Yes, “Travel and subsistence as actual costs” may eb considered as eligible costs.

|

Yes, “Full capitalized costs” can be considered eligible costs under a HUMA Action. |

|

The eligibility conditions are set in Article 6.1 and 6.2.C of the MGA and in it’s Annex 5. |

Yes, cash support to final beneficiaries is considered to fall under ‘financial support to third parties’. By filling in the Single Form and the required Annexes, the partners meet the five criteria under art. 6.2 D.1. (a) of the MGA. The application of art. 6.2 D.1 means that the amount of cash support provided to final beneficiaries must be listed in the budget template under category D.1.

Cash support to final beneficiaries is exempted from the application of art. 9.4, and final beneficiaries do not have to be included in the data sheet.

They should report only on the incurred costs.

Yes, where due to particularly dangerous operating conditions, humanitarian aid workers or field offices are exposed to increased risk, the DG ECHO Partner may include as Action costs any justified increased costs that are necessary and directly linked to the implementation of the Action.

Costs necessary for the protection of staff and/or the field offices may be included in the Action Budget, as follows:

• Staff Costs - Where costs relate to the needs of a staff member and may be included as part of the Partner’s corporate staff renumeration package (e.g. medical and life insurance, additional allowances for dangerous postings or travel costs, in-kind support etc.) these costs should be included in the Action budget through the daily staff rate/unit costs used to calculate staff costs based on either of the two available calculation methods. There is no threshold for personnel costs (See FAQ N° 31) but all personnel costs must be duly justified and incurred and can be verified ex post by the Commission during checks and audits. This applies to costs related to both international staff and local staff. (See FAQ 94 & AGA - Article 6.2.A.1 Employees).

In this context, any costs such as measures to ensure the well-being and safety of implementing partner staff must be clearly visible and properly documented within the action budget to be considered eligible.

Field Office Costs - Where costs relate to the needs of running the field office, these costs should be included in the Action budget through the related unit costs based on the Partner’s usual cost accounting practices based on an objective, fair and reliable allocation key, that can be verified ex post by the Commission during checks and audits. The list of “Field office costs” is provided in the “Decision authorising the use of unit costs for staff and field office costs using usual cost accounting practices under the Humanitarian Aid Programme”. These may include, costs related to buildings, security systems, equipment, travel and subsistence costs for staff and other persons directly assigned to the operations of the project office; costs of facility management contracts, including security fees and insurance costs specifically awarded for the operations of the project office (See FAQs 43, 145).

Yes, if an external audit is mandatory under the applicable national legislation, the audit costs may exceptionally be considered eligible. This applies to cases of action-based audits as well as audits of a wider scope (e.g. annual, systems or organisational audits). In order to have these costs charged to the action the partner has to indicate and justify it in chapter 9.4. of the e-Single form.

In cases where the audit is wider than the DG ECHO-funded action, the calculation of the costs that can be eligible, must be made carefully to ensure proportionality and avoid double funding. The costs of audits of a wider scope are typically a part of the field office costs and are usually declared as shared costs (unit costs based on the usual accounting practices). Otherwise, if these are declared as eligible as direct costs – this may be done only provided that the costs are incurred within eligibility period and counted in the proportion to DG ECHO’s action duration.

In cases where the cost covers an audit that has been carried out after the action’s implementation – it can only be an audit of the action (which justifies the eligibility of its costs after eligibility period) and, as all cases above, it has to be mandatory under the national legislation.

These external audit costs should not be confused with the costs of the CFS when expressly required in the MGA (see FAQ 269).

They should report only on the incurred costs.